Setting Up Reimbursement Rate Stages for Legal Travel Allowances in Germany: A Guide for Accountants

In Germany, until the year 2020, the statutory travel allowance was 30 cents per kilometer traveled.

From 2021 until 2023 |

|

From 2024 until 2026 |

|

Starting from the 21st kilometer, the allowance increased to €0.38/km for the year 2024

Configuring mileage scale tiers based on the new statutory travel allowance scale:

A/German Account:

- Click on the Admin tab, then select the Mileage Rates submenu.

- Check the setting Set rate stages for each trip.

- A table will appear, allowing you to set up the mileage rates per trips.

- Configure 2 rates:

- If the distance (FK) < 21 km => rate = 0.3

- If FK ≥ 21 km => rate = 0.35

Example:

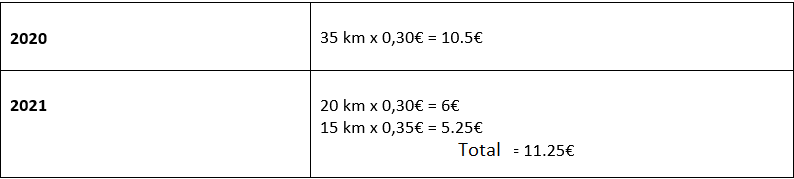

Let's assume your commute to work is 35 kilometers. The higher travel allowance from 2021 would make a difference of 0,75 euros for you.

When is the Compensation Applied?

When the administrator adjusts the tiers during a year, compensation is applied to regularize the sum of mileages that were created before configuring the tiers.

To apply the comepnsation, the admin needs to go to the Admin tab > Mileage rate and follow the steps explained below.

- Go to the Admin tab.

- In the Mileage Rate submenu, check Activate "compensation mechanism" for mileage