Bank Integration and Expense Matching

Integrating your bank with Expensya allows you to import transactions from your accounts automatically or manually. Once the transactions are imported, you can use them to match existing expenses or create new expenses. Understanding how this process works helps you manage expenses more efficiently, reduces errors, and ensures accurate reporting.

This guide explains:

- How the system handles bank transactions in different scenarios.

- How it matches them with expenses.

- What to expect depending on whether a transaction arrives before or after an expense is created.

How matching works

After transactions are imported, the system analyzes each transaction individually to determine whether it corresponds to an existing expense. This process, called matching, is based on several specific factors:

- Amount – compares the transaction amount with the expense amount.

- Date – checks if the transaction date matches the expense date.

- Payment instrument – compares the method of payment used.

- Source of the expense – identifies the source of the expense in the system (for example, credit card).

- Merchant name – checks the correlation between the merchant name in the transaction and the recorded expense.

- VAT number – compares the VAT number, if available.

- Expense category – verifies if the transaction category matches the expense category.

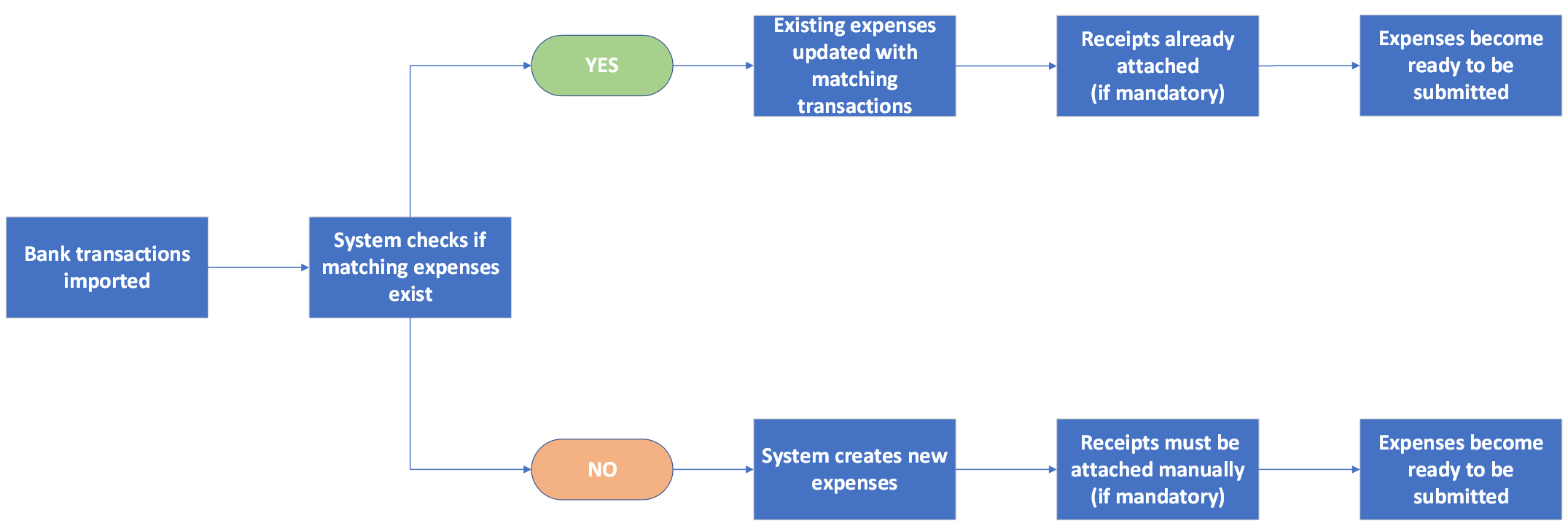

Each factor contributes to an overall score. If the score reaches the defined threshold, the transaction is automatically linked to the existing expense. If no suitable match is found, the system creates a new expense from the imported transaction.

Example 1 - Transaction matches an existing expense

Imagine you have an existing expense for a dinner at X Restaurant for $75 on October 15th. When a transaction is imported later for a dinner at the same restaurant for $75 on the same date, the system analyzes it using the matching criteria:

- Similarity in amount - both amounts are $75 (high match).

- Similarity in date - both transactions occurred on October 15th (high match).

- Payment instrument - both transactions were charged to the same credit card (high match).

- Merchant name correlation - the transaction is from X Restaurant, which matches the recorded expense (high match).

- VAT number and category - if these details match, they further enhance the score.

Once the system confirms the match:

- The transaction is added to the existing expense and appears in the Related transactions tab.

- Billable to client and To Reimburse fields remain unchanged.

- Custom fields are not updated.

- The expense is ready to be submitted.

Example 2 - Transaction does not match any existing expense

Suppose a transaction is imported for a dinner at Y Restaurant for $50 on October 20th, and no existing expense corresponds to that amount and date.

When the system runs the matching process and finds no corresponding expense:

- A new expense is automatically created from the transaction and shown in your expense list.

- Custom fields are filled during import.

- Billable to client and To Reimburse fields are unchecked by default.

- If the expense category requires a receipt, the expense remains in the To Review status until the receipt is attached. Otherwise, it is set to To Submit.