Tax Management for Canadian Expenses

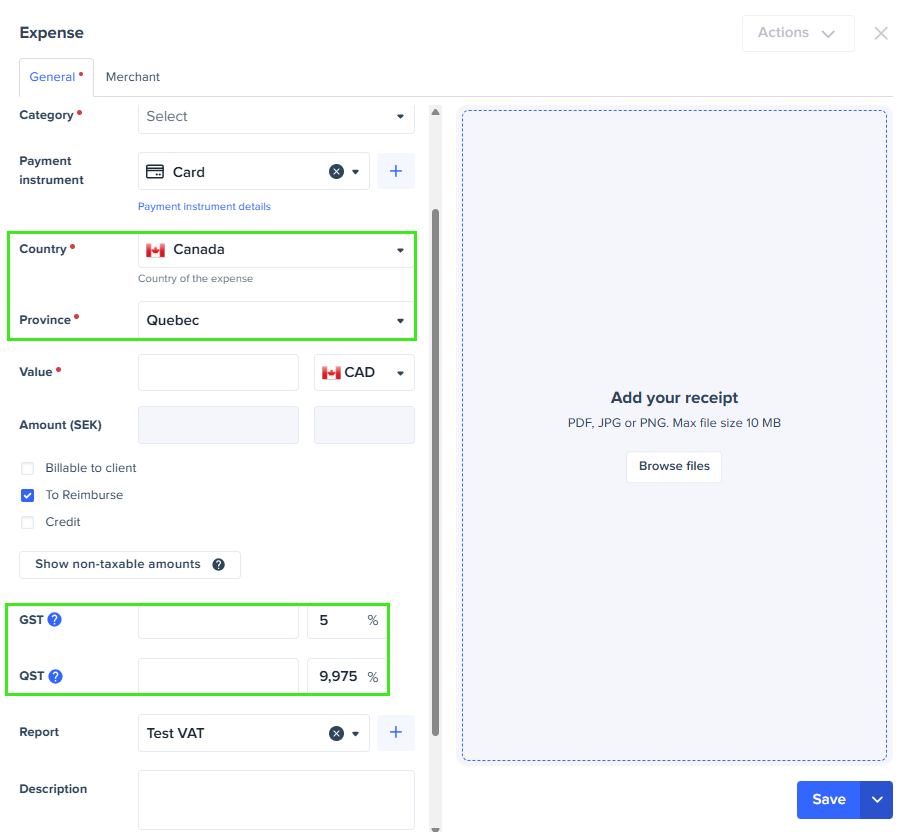

When the expense country is Canada, a mandatory field appears to select the appropriate province. This will make the system display the relevant tax fields for that province and fills them in with accurate values.

This functionality is enabled upon request. Contact Expensya support to activate it.

Province-specific taxes

Depending on the province you select, you may see one or more of the following tax fields:

- GST (Goods and Services Tax)

- PST (Provincial Sales Tax)

- HST (Harmonized Sales Tax)

- QST (Quebec Sales Tax)

You cannot add or remove tax lines manually. The system creates them automatically based on your selected province.

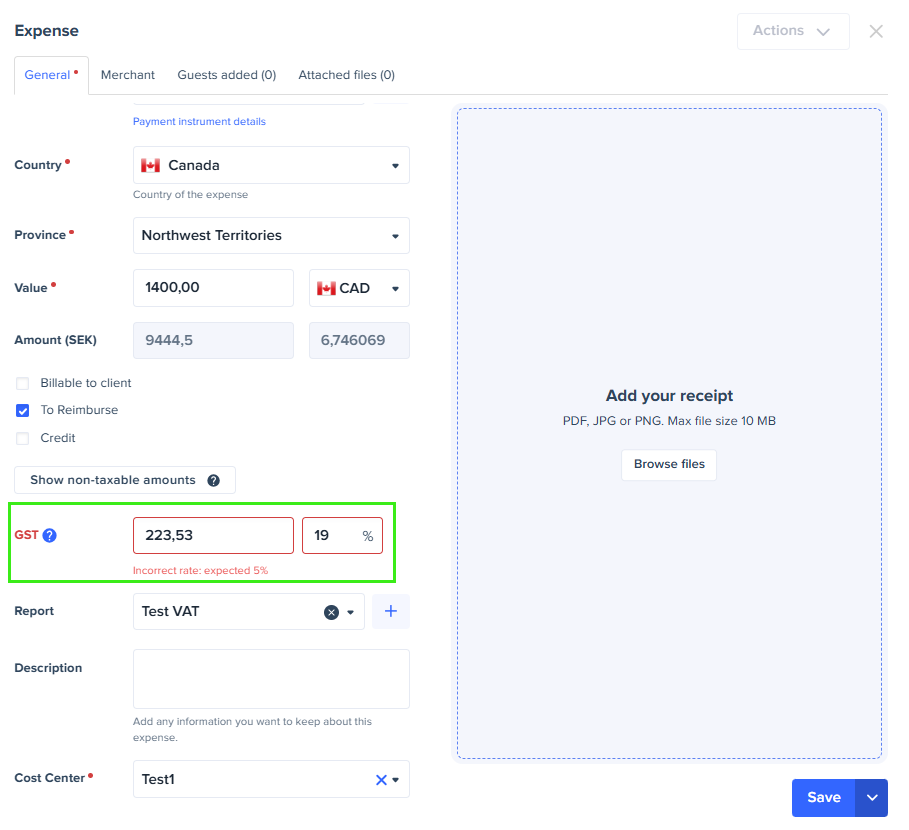

Tax validation

- If tax validation is enabled for your tenant, the system checks if the tax rates match official provincial rules.

- If the rates are incorrect, you cannot save the expense.

The tax validation option can be enabled upon request. Contact Expensya support to activate it.

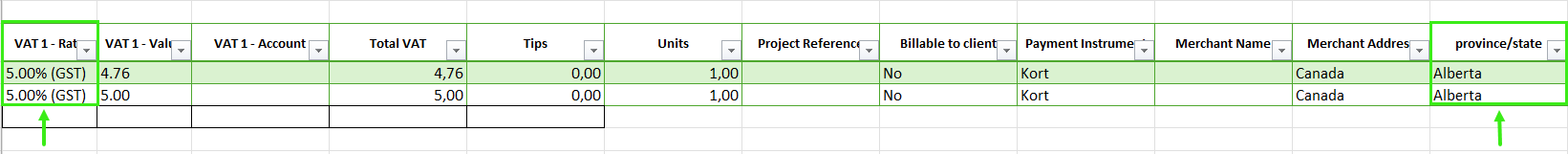

Export

You can see VAT and province information in the exported file.