Adding an Accounting Configuration by Country or Region

You can configure expense categories in Expensya to align with different tax codes and VAT accounts, and claim rates for specific countries, regions, or provinces.

This functionality simplifies the management of accounting categories across multiple tax jurisdictions, ensuring accuracy and compliance.

Steps to configure accounting by country or region

Follow these steps to set up accounting configurations for different countries or regions:

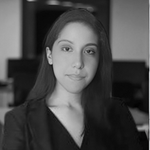

- Go to the Admin panel, select Advanced Settings, and then click Categories.

- Click the category you want to edit, then go to the Accounting tab.

- Under the VAT per region section, click Add region to enter custom tax information.

- Select a region to customize from the drop-down menu.

- Enter the Rate (%), Tax code/VAT account, and Claim rate (%).

- Click Add a VAT rate to include as many rates as needed for each region or country.

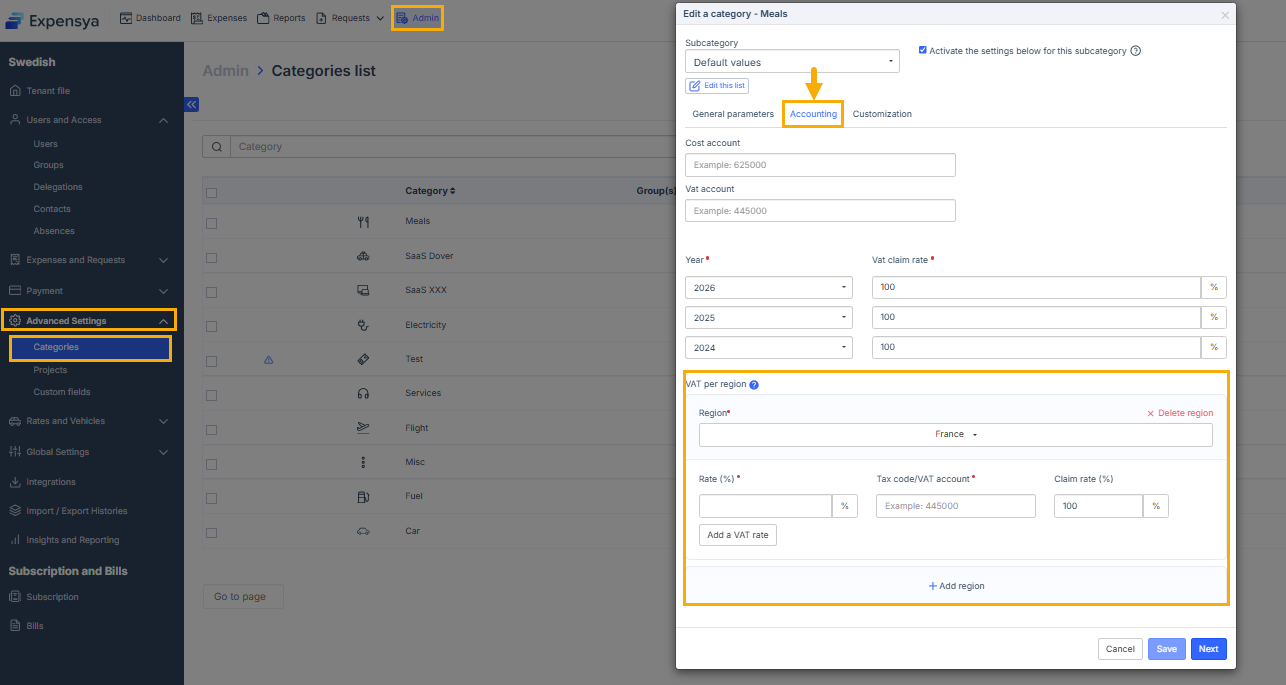

- If you select Canada as a region, the following behaviour applies:

- The interface will change to show general Canadian tax settings, including GST, PST, HST, and QST.

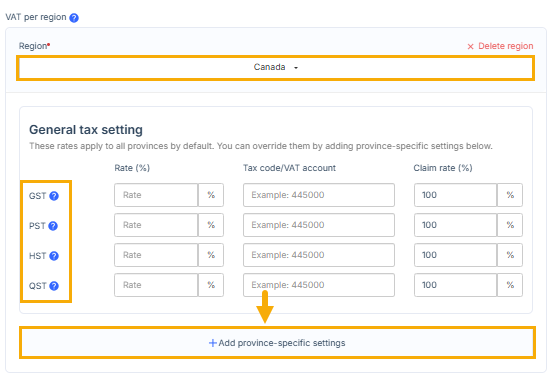

- To change tax rates for a specific province within Canada, click Add province-specific settings.

- Select a province. Relevant taxes will appear.

.

- Make the necessary changes and click Save.

When you select Canada as a region, you will no longer be able to choose another region.

Important considerations

- You can assign only one VAT configuration per country or region within the same category. This prevents conflicts and ensures clarity.

- When geographical VAT settings overlap, the system applies the most specific setting in the following order: country-specific, region-specific, then default (all-region).

Impact on expense exports

When exporting expenses, Expensya automatically applies the correct VAT details based on the expense’s country or region. This guarantees accurate reporting and compliance while minimizing errors.