VAT Overview Dashboard

Expensya's VAT Overview Dashboard is a powerful tool designed to help organizations track, analyze, and optimize their VAT recovery process. By providing clear visibility into VAT-related expenses, this dashboard enables businesses to maximize reclaimable VAT while ensuring compliance with tax regulations.

Key Features

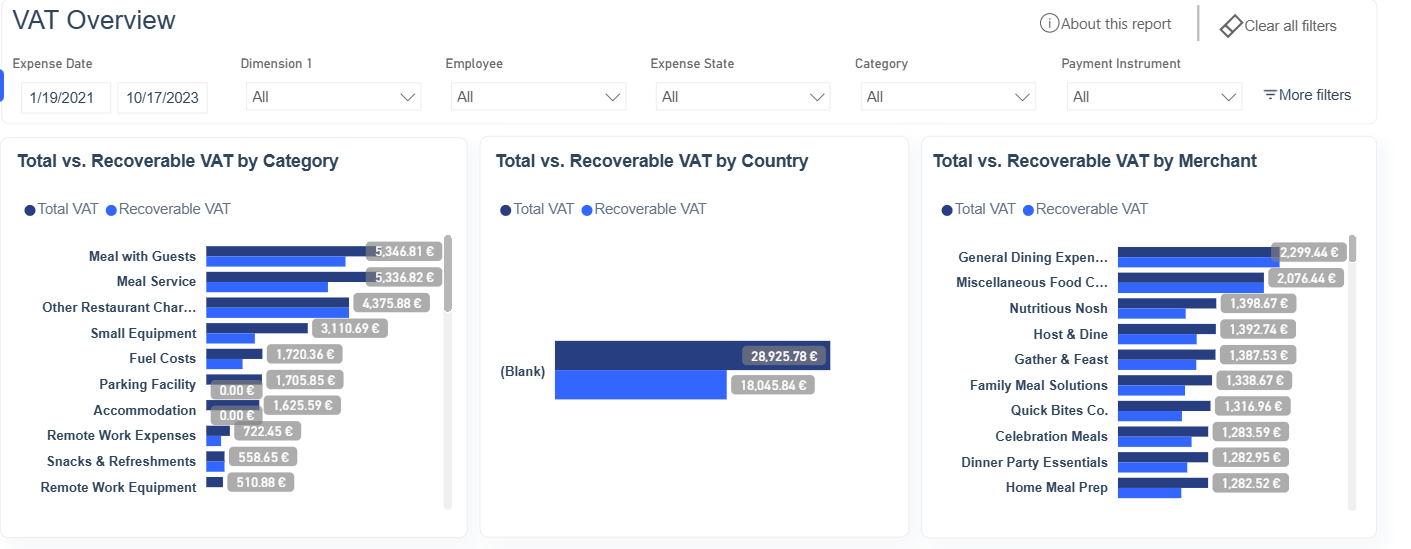

- Total vs Recoverable VAT by Category

The dashboard categorizes expenses to differentiate between total and recoverable VAT. This breakdown allows businesses to identify which expense categories contribute most to recoverable VAT and adjust their spending policies accordingly.

- Total vs Recoverable VAT by Country

For businesses operating in multiple countries, the dashboard provides a comprehensive view of VAT recovery across different regions. This feature helps organizations comply with varying tax regulations and optimize their VAT claims based on local laws.

- Total vs Recoverable VAT by Merchant

Understanding VAT recovery at the merchant level is crucial for financial planning. The dashboard displays VAT amounts by vendor, allowing businesses to identify which suppliers contribute most to reclaimable VAT and optimize their purchasing decisions.

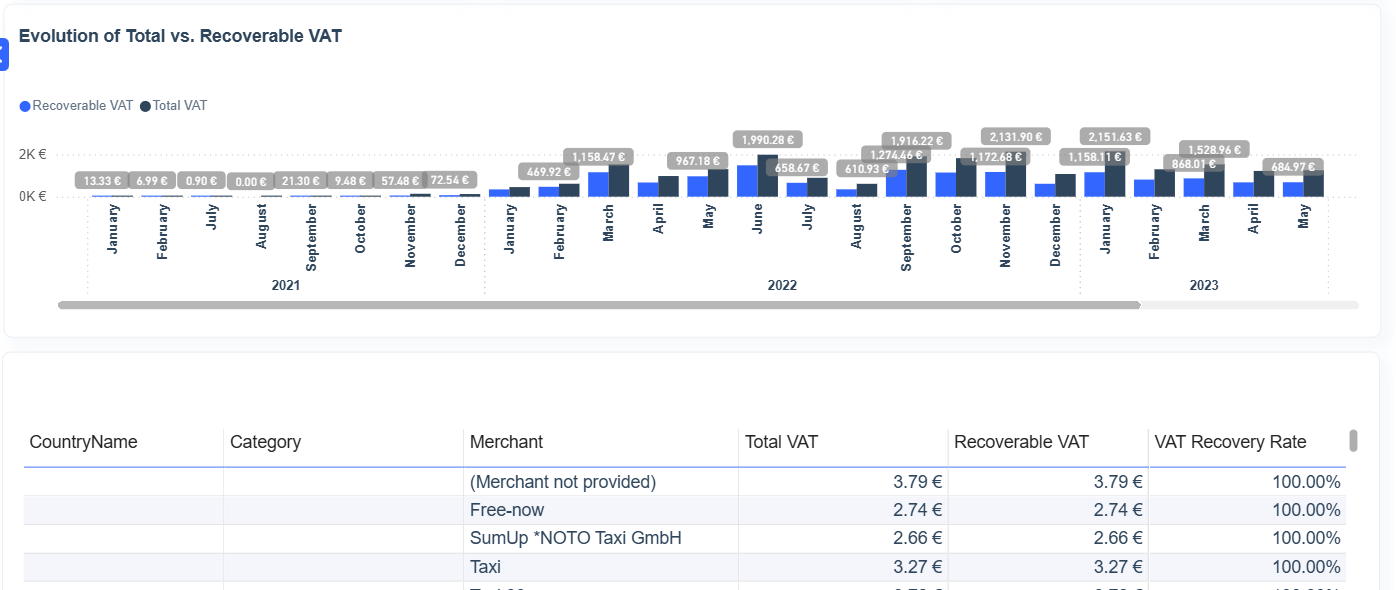

- Evolution of Total vs Recoverable VAT

Tracking VAT trends over time is essential for financial forecasting. The dashboard allows you to visualize the evolution of total and recoverable VAT, enabling organizations to assess the impact of expense policies and refine their VAT recovery strategies.

Benefits

- Optimized VAT Recovery

By providing clear insights into VAT-eligible expenses, the dashboard helps businesses maximize their VAT recovery potential. This leads to significant cost savings and improves financial efficiency.

- Enhanced Compliance and Accuracy

With detailed tracking and categorization, the VAT Overview Dashboard ensures that VAT claims comply with tax regulations. This minimizes the risk of errors and enhances the accuracy of VAT submissions.

- Improved Financial Visibility

The dashboard provides up-to-date data and analytics, refreshing daily to help finance teams make informed decisions. By understanding VAT trends, businesses can better manage their budgets and financial strategies.

- Proactive Expense Management

By highlighting areas where VAT recovery can be improved, the dashboard enables organizations to proactively adjust spending policies. This ensures that expenses align with VAT recovery goals and enhances overall financial planning.