Creating Categories and Configuring the Chart of Accounts - Guide for Accountants

To create a category and configure the expense accounts, the admin must follow the steps detailed in the following article; How to create a category and configure my chart of accounts? - Expensya - Expense Reports - Online Help

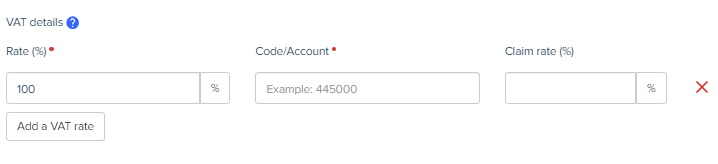

Adding a VAT code/ account per rate:

Admins are also able to manually set VAT accounts per rate for categories on the Web interface, to do this they must follow the steps explained in this article ; How to create a category and configure my chart of accounts? - Expensya - Expense Reports - Online Help

The configurable parameters are the following:

- Rate (percentage field): Mandatory and unique, allows admins to enter a numeric value representing the VAT rate associated with the category as a percentage.

- Code/Accountant (free field): Mandatory, field accepts alphanumeric input, allowing for a combination of letters and numbers to define a unique identifier for the VAT rate.

- Claim rate (percentage): Optional, allows admins to enter a numeric value representing the percentage of VAT that is recoverable for the category.

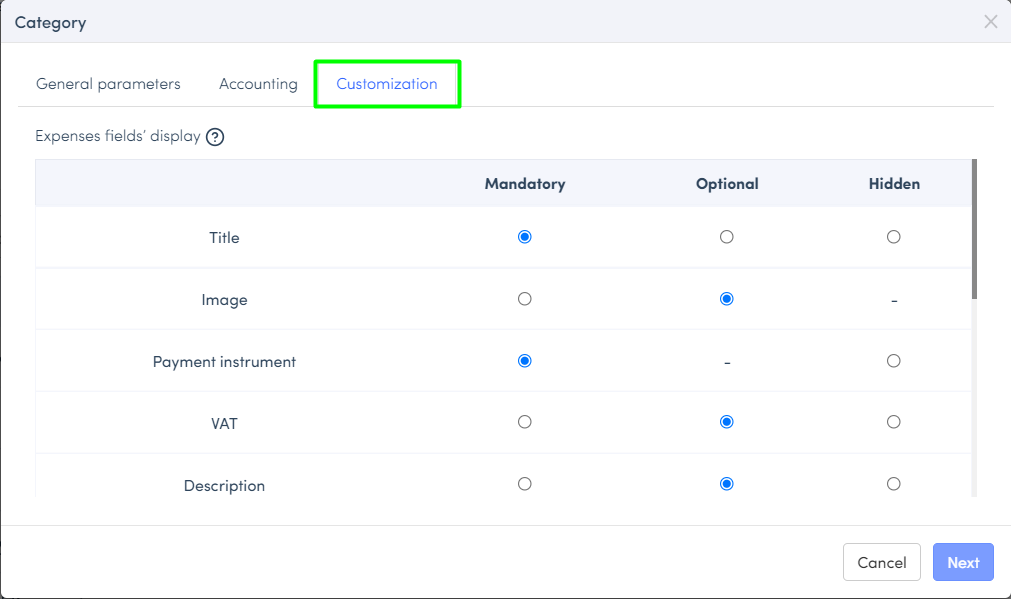

To customize the fields in your expense form:

The admin is also able to customize the fields in the expense form, You can hide the title, make the image mandatory (payment receipts), hide VAT, etc.

It is also possible to configure scan technology of this category and save it.

OCR, or Optical Character Recognition, becomes an essential ally in creating and customizing categories in Expensya.

By merging OCR with category customization, Expensya automatically transforms key receipt information into organized data within personalized categories. This enhances the efficiency of category management.

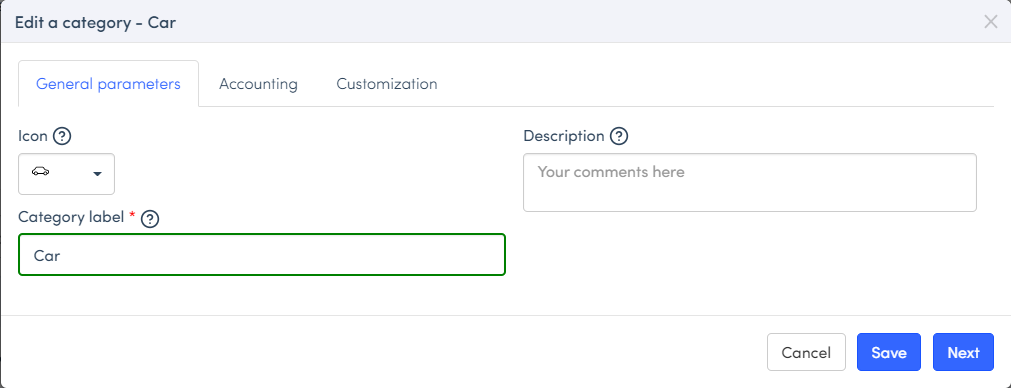

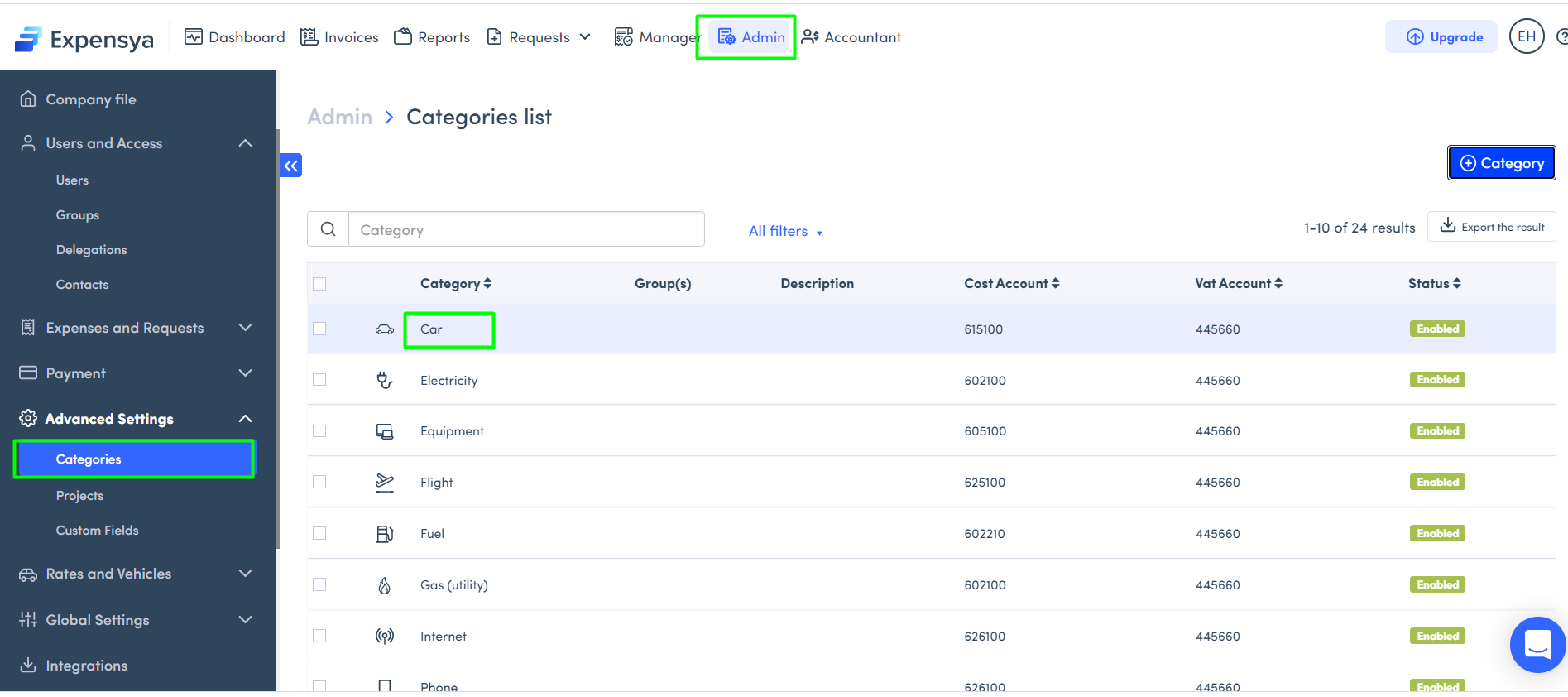

To modify a category, the admin of your tenant needs to follow these steps.

- Go to the Admin tab, > Advanced Settings > Categories sub-menu,

- Select the category you want to modify (e.g. “Car”)

You can make your changes from the General Settings tab, Accounting, Customization and Scan technology if necessary.

- Save.