Per Diem with Taxable Value Export

This functionality allows you to report the taxable difference between your tenant's per diem rates and the default rates set by some countries, particularly Nordic countries. In these countries, per diem amounts above the authorized rate are taxable.

The export provides a detailed breakdown of the taxable value for each per diem expense. This simplifies integration with payroll solutions, such as Visma in Sweden.

How to export per diem expenses with taxable value

Follow these steps to export the per diem data with taxable value:

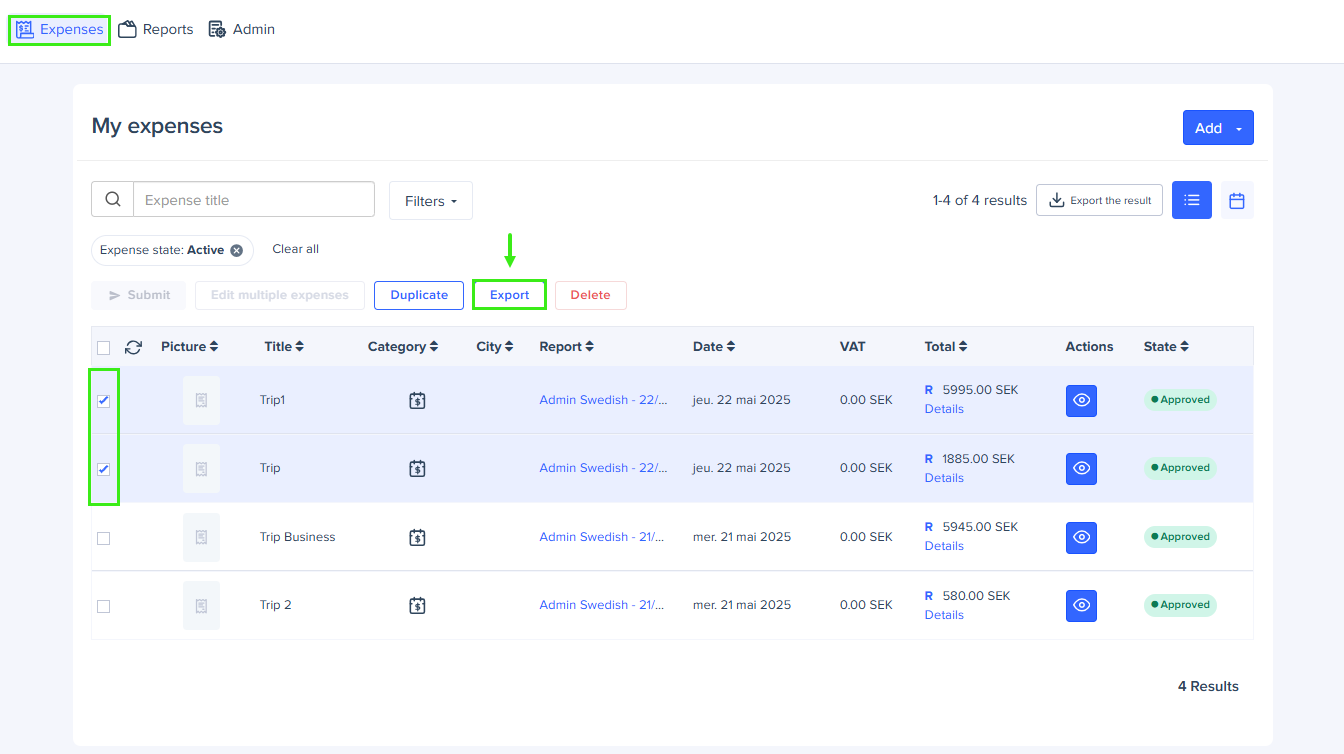

- Go to the Expenses tab.

- Select the per diem expenses you want to export, then click Export.

Note that you can only export submitted expenses.

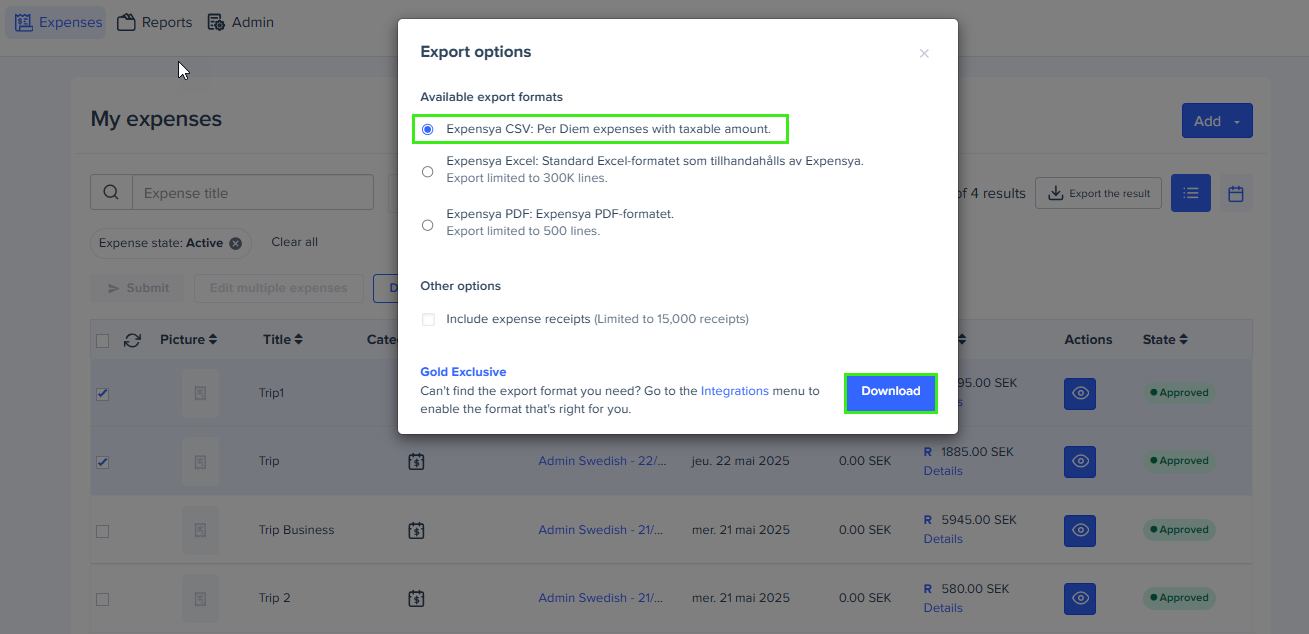

- From the list of export formats, select Per diem expenses with taxable amount.

- Click Download to receive the export.

Data included in the export

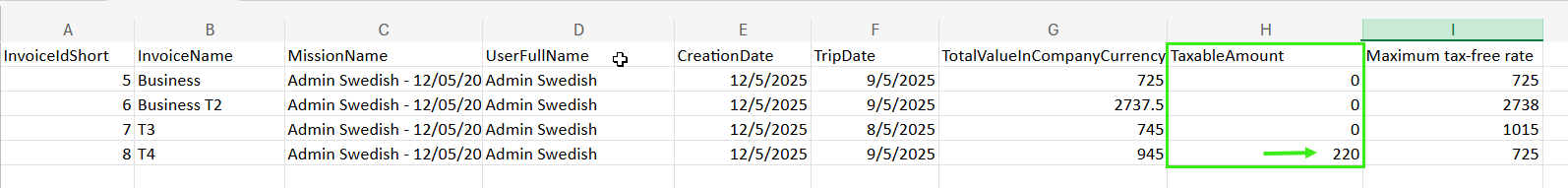

The export contains the following columns for each entry:

- Invoice ID: unique identifier for the per diem entry.

- Invoice name: name assigned to the per diem invoice.

- Mission name: name of the mission associated with the per diem entry.

- User full name: full name of the employee who submitted the per diem expense.

- Creation date: date when the per diem entry was created.

- Trip date: actual travel date.

- Total value in company currency: full per diem amount based on your company’s configuration.

- Taxable amount: the difference between the total value and the maximum tax-free rate. It is calculated per day using this formula:

Taxable value = Total value – Tax-free rate.

- Maximum tax-free rate: maximum non-taxable amount defined in the country’s default configuration.

In countries with long-trip rules, the system automatically adjusts the taxable value to ensure compliance. For instance, in Sweden, the taxable amount is reduced by 30% after three months on the same assignment. This adjustment is included in the export.