Spending Policy Configuration Options

In order to bring clarity and optimal control over spending policies, it is important to understand and configure the rules governing them judiciously. Our article aims to demystify these crucial parameters, thus providing a detailed perspective on how to customize financial guidelines within your organization.

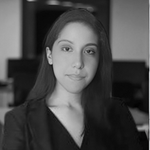

Spending Policy Rules:

Expensya offers four types of spending policy rules, each with its own objective and benefits.

Key Info

This rule informs employees on spending policy.

For example, you can create a key info rule for expenses exceeding a certain amount, thus generating a notification to make users aware of it.

Flat fee notice

Flat fee notice rules allow for setting a fixed amount or a range of authorized expenses for certain categories. This ensures that expenses remain within predefined limits.

For example, you could set a flat fee notice for meal expenses, thus limiting excessive spending.

Not allowed

This type of rules prevents users from making expenses that do not comply with established policies. These rules are strict and prevent any action that violates the guidelines.

For example, you could implement a "Not allowed" rule to prevent expenses outside of working hours.

Limit exceeded

These rules set maximum spending limits for specific categories. This helps control costs and prevent excessive spending.

For example, you could impose a monthly ceiling for business trips.

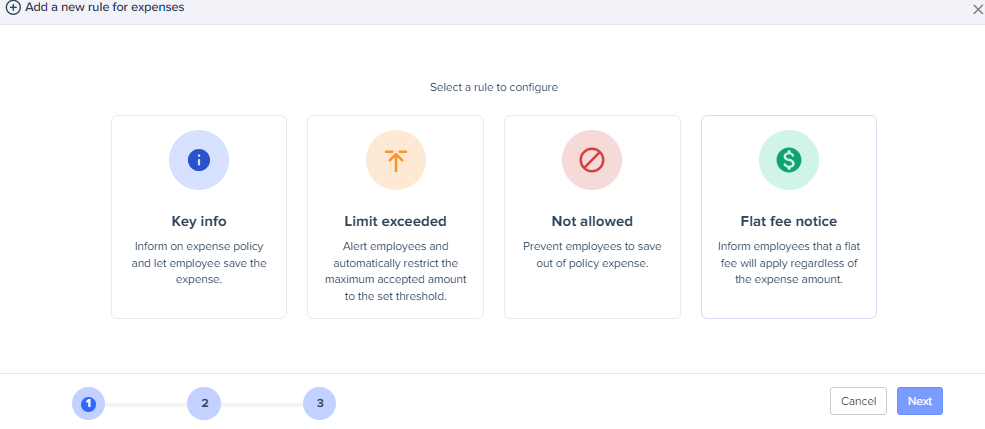

Rules Application Conditions:

- Expense Date:

Example: A tenant might restrict transportation expenses only to weekdays for internal policy reasons. Thus, expenses incurred on weekends would automatically be subject to specific conditions following the established rule.

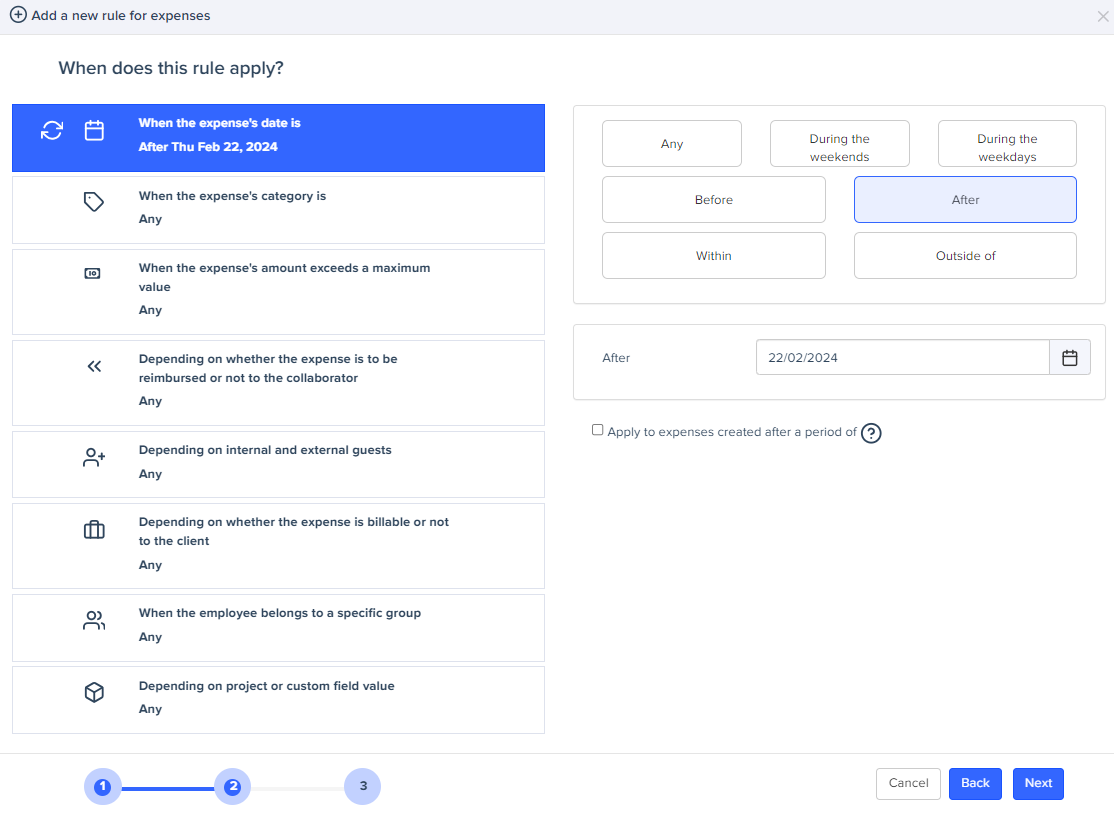

- Expense Category:

Example: If a tenant wishes to control meal-related expenses, it could create a specific rule that applies only to "Meal" and "Dining" categories, thus limiting the use of funds for this type of expense.

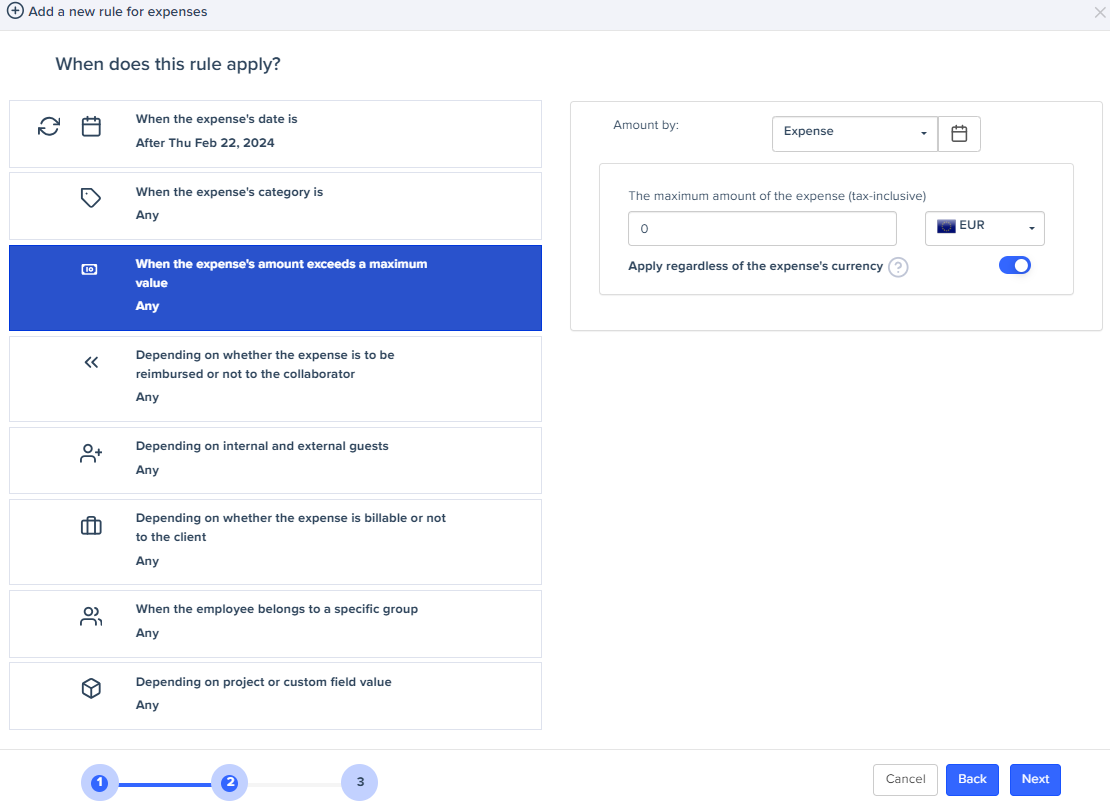

- Maximum Expense Amount:

Example: A tenant could set a €1000 ceiling for travel expenses. If an employee submits a travel expense exceeding this limit, the rule will trigger.

You can activate the option "Apply regardless of the expense's currency ". By activating this setting, the rule will be applied regardless of the expense's currency. If this button is disabled, the rule will be applied only for expenses that have the rule's currency.

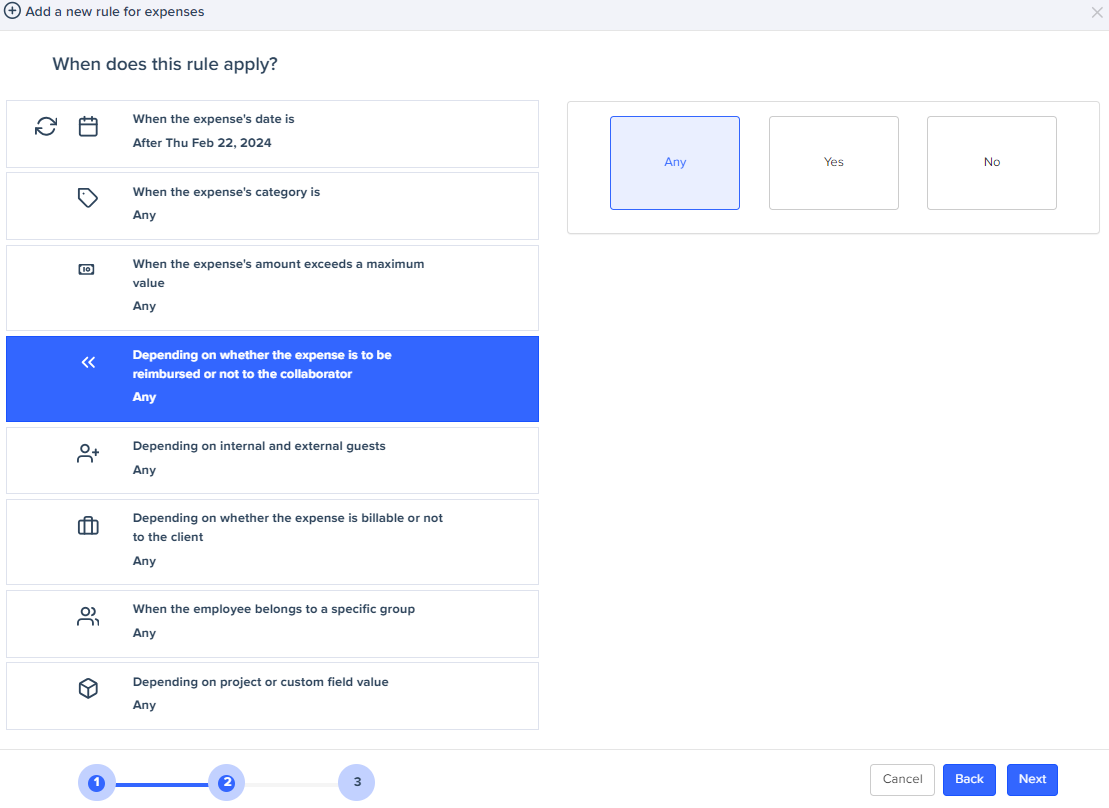

- Expense Reimbursement:

Example: This option allows companies to choose whether the rule applies only to reimbursable, non-reimbursable expenses, or regardless.

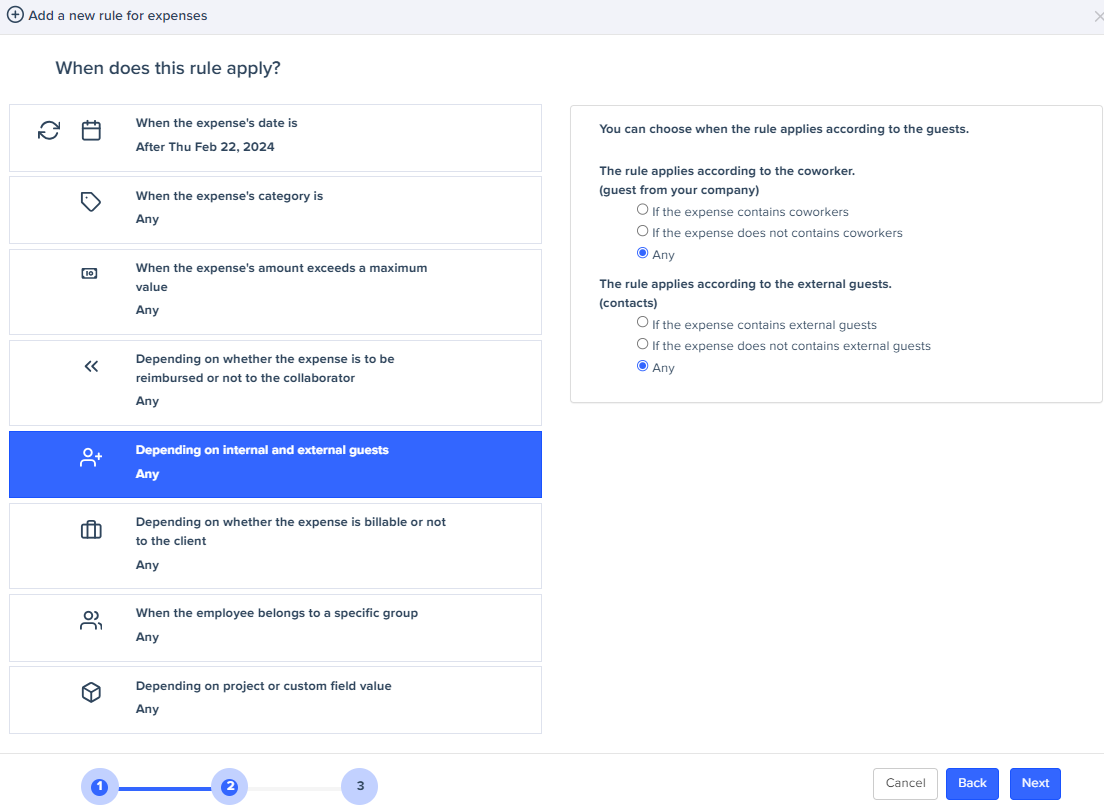

- Internal and External Guests:

For internal guests: A tenant could apply a specific rule to expenses shared with guests.

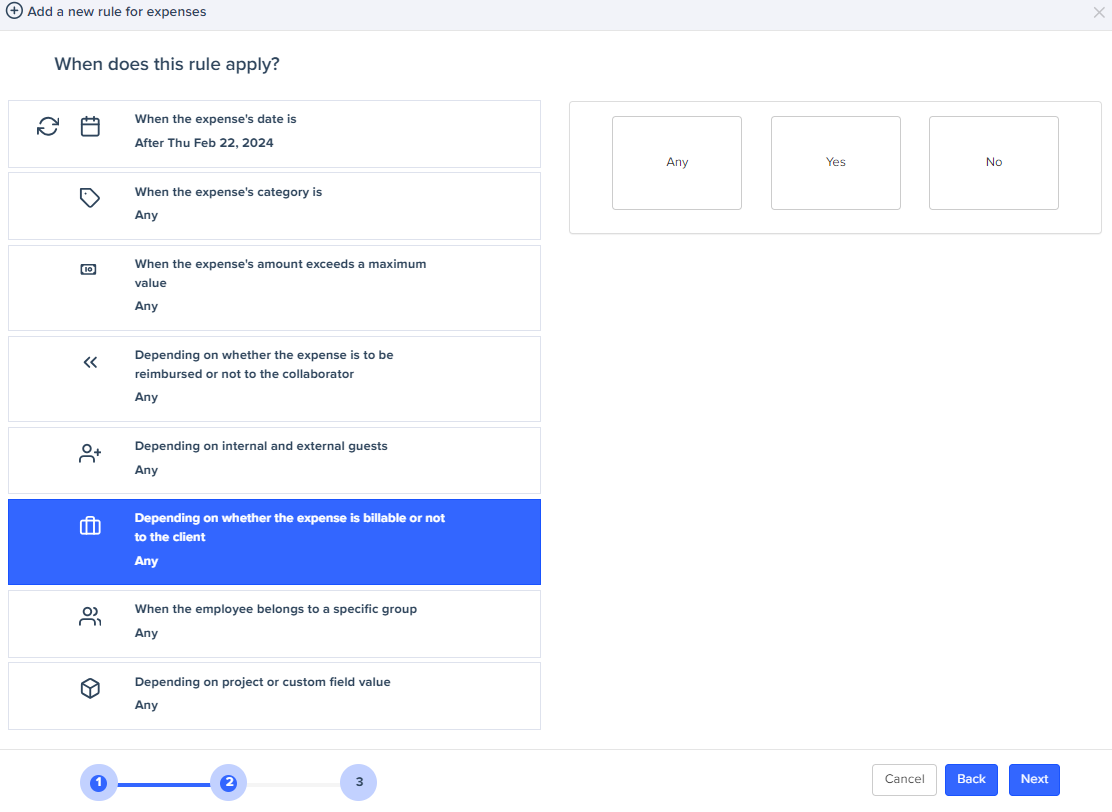

- Client Billability:

Example: A tenant can apply specific rules to expenses that will be billed to its clients.

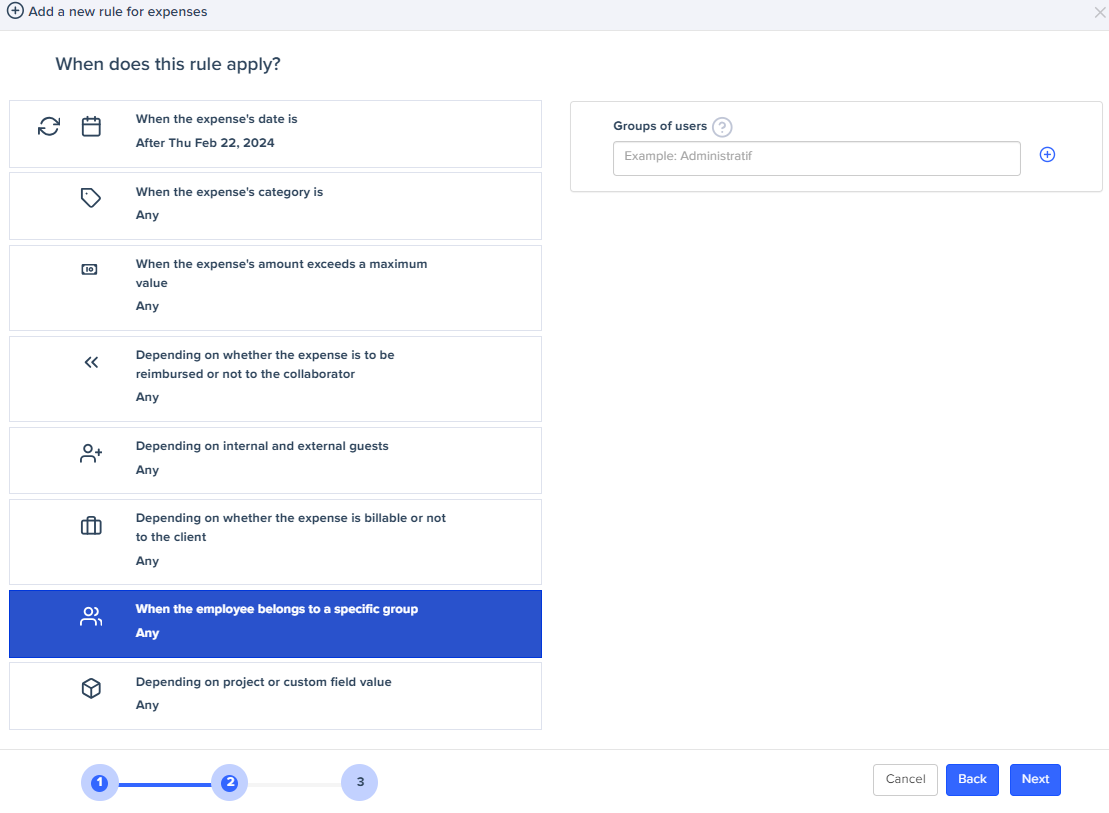

- Membership in a Specific User Group:

Example: A tenant can assign an expense rule to one or more groups, allowing for more targeted management of allocated budgets.

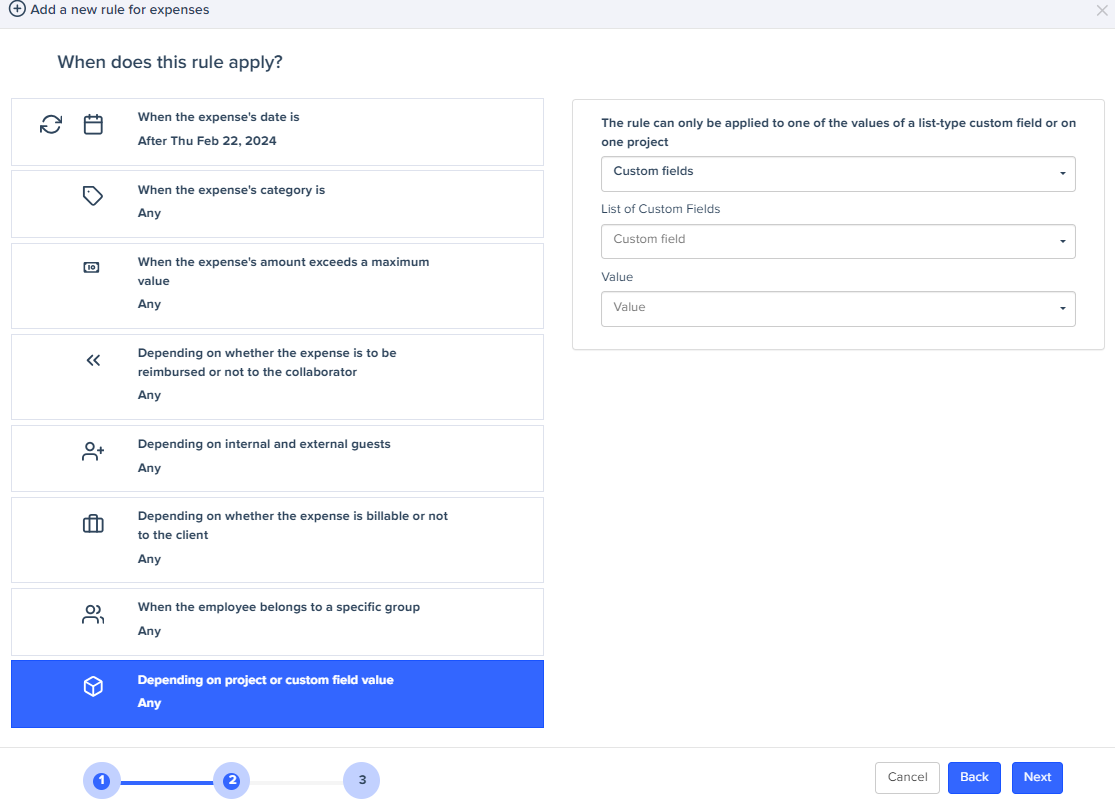

- Business or Custom Field:

Example: A tenant working on different projects could create specific rules for each project or for a value of a custom field it has already created.