Managing Suspicious Transactions with Expensya Cards

Expensya cards offer an AI-powered system that detects, scores, and categorizes suspicious transactions, and then alerts you immediately.

This adds an extra layer of control beyond standard Mastercard and payment provider checks. You can quickly spot potentially fraudulent spending and take the necessary action.

What makes a transaction suspicious?

AI analyzes transaction behavior and highlights anything out of the ordinary, such as:

- Amount significantly higher than typical spend

- Transactions made in an unexpected country or currency

- Unusual merchant compared to historical behavior

- Several unrelated purchases in a short time. This may suggest that the card was stolen and is being used quickly before it’s blocked.

What happens when a transaction is flagged as suspicious?

When the AI detects a suspicious transaction, it flags it to ensure timely review and action.

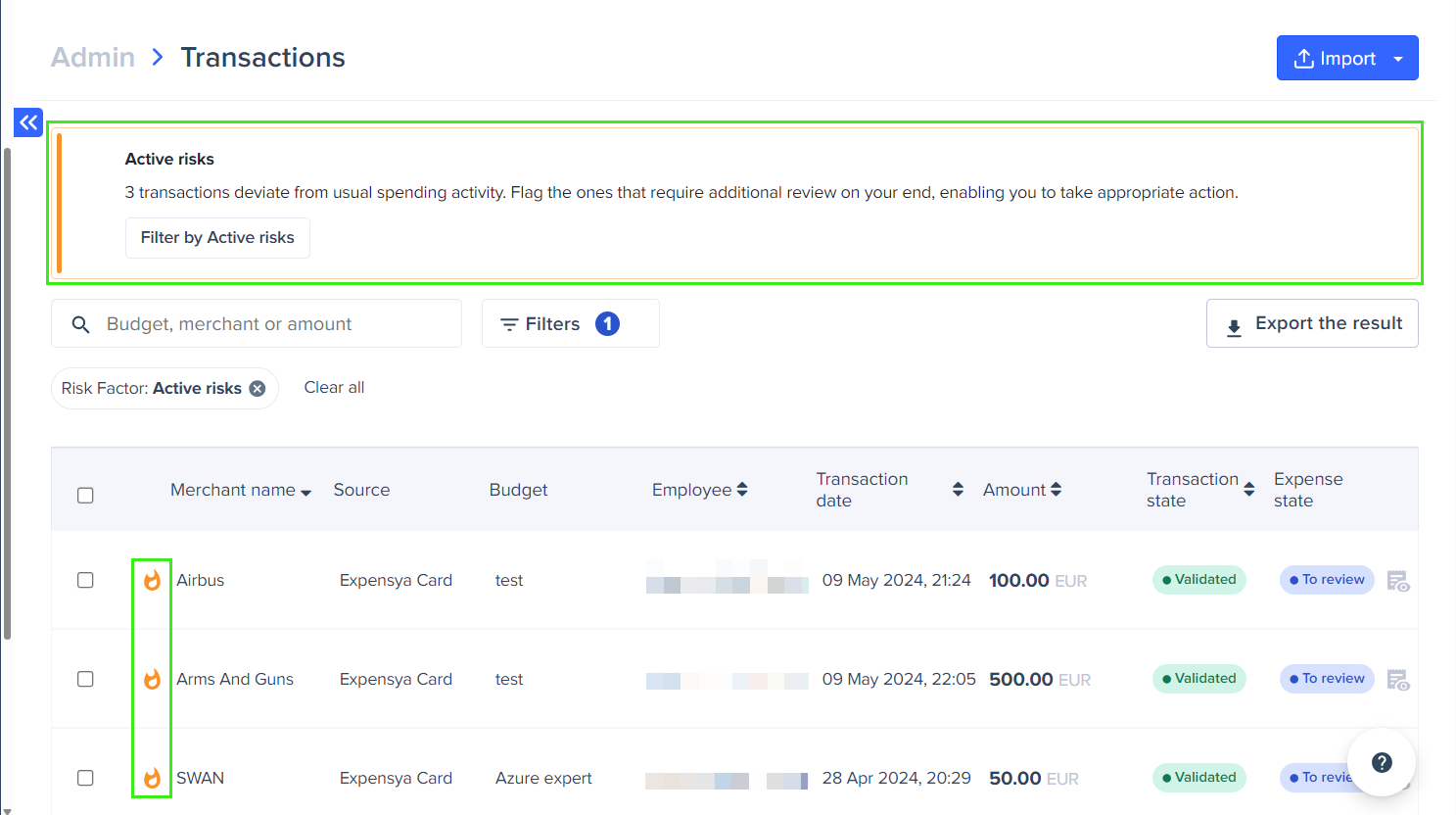

Suspicious transaction alerts are visible at multiple levels for the administrator, the manager, and the cardholder, as follows:

- In the transactions list, where a banner at the top shows how many transactions need your review.

- On related expenses.

- On reports that include suspicious transactions.

How to handle a suspicious transaction?

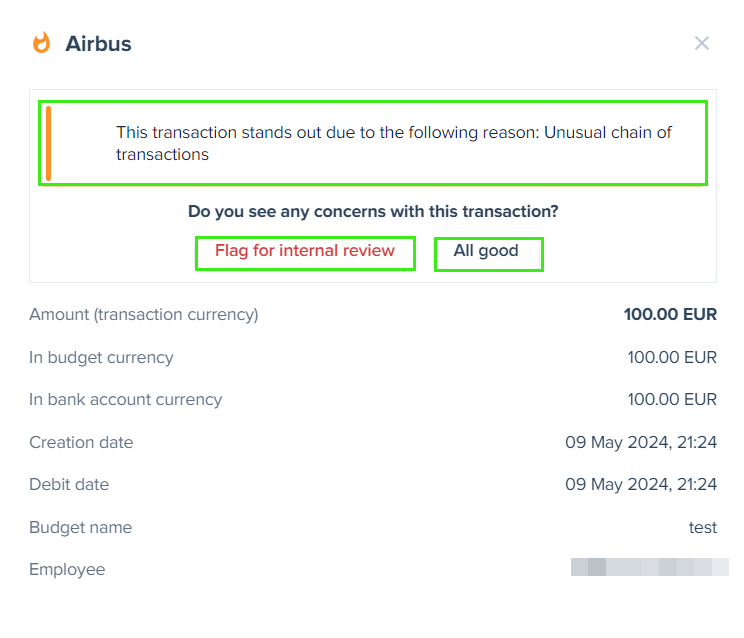

To review a suspicious transaction, select it from the list. Then choose how to handle it:

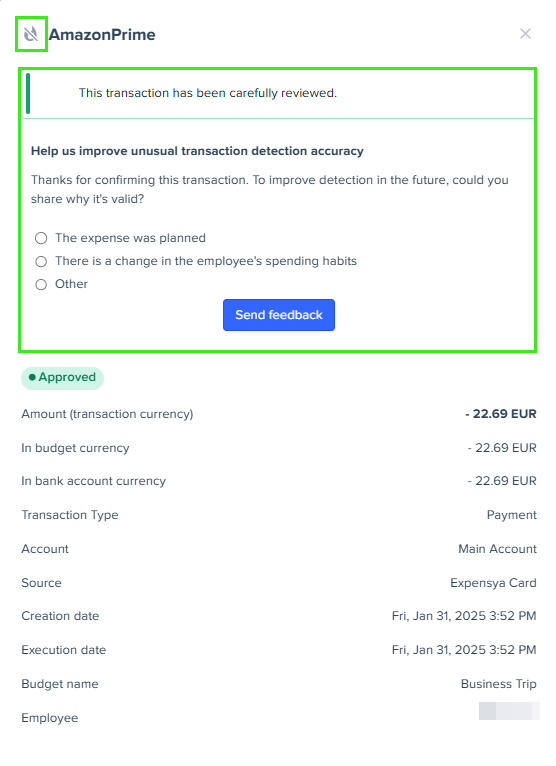

- Click All good to mark the transaction as safe. The fire icon will then turn grey. The system will also request feedback to help the AI learn what normal behavior looks like for the tenant.

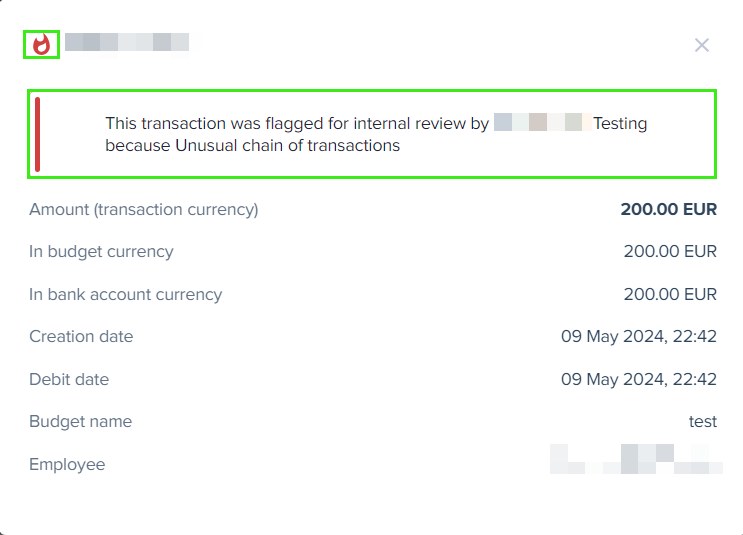

- Click Flag for internal review to send the transaction for further checks. The fire icon will then turn red.

How does feedback on suspicious transactions improve detection accuracy?

- When you mark a transaction as All good, the system requests feedback. This helps define normal behavior for the tenant, improves detection accuracy, and prevents unnecessary alerts.

- If a transaction is confirmed as suspicious, no feedback is required. Depending on the situation, you can ask the cardholder for further details on the transaction, close the related budget to block additional spend, suspend the card, or contact the support to request a refund.

Use cases illustrating AI improvements

To show how the enhanced AI works, here are a few real-world scenarios:

- Scenario 1: Budget-approved travel

- Context: A cardholder makes a successful transaction in Tunis under a pre-approved budget titled Trip to Tunis.

- Improvement: When reviewing this transaction, the AI takes the budget reason into account. The transaction is not flagged as suspicious, which helps reduce unnecessary alerts for admins.

- Scenario 2: Familiar merchant with high amounts

- Context: A cardholder makes a high-value purchase with Figma, a merchant where previous high-value transactions were marked as All good by admins.

- Improvement: The AI considers the history of admin feedback for this merchant. It recognizes the transaction as valid and avoids sending a false alert.

- Scenario 3: Refunded transactions

- Context: A cardholder completes a transaction that is later refunded.

- Improvement: The AI detects the refund and automatically excludes the transaction from suspicious activity analysis. This prevents unnecessary admin alerts.