How can I manage the recoverable VAT on Expensya?

The Value Added Tax (VAT), primarily known as "Tax on Value Added," is a consumption tax paid by the consumer, collected by the company, and remitted to the state.

It is typically included in the final selling price of a product or service and can be reclaimed by the companies subject to it.

Expensya manages specific VAT rates for:

- France: 0%, 2.1%, 5.5%, 10%, 20%

- Corsica: 20%, 13%, 10%, 2.10%, 0.90%

- French Overseas Departments (DOM): 8.5%, 2.10%, 1.75%, 1.05%

Reclaiming VAT on Expensya

On Expensya, the recovery of VAT is related to expenses incurred by companies for their employees in the course of their professional activities. This includes all expenses for meals, travel, communication, training, etc., that employees submit as expense reports.

It's important to note that VAT can only be reclaimed on expenses that have been paid, not on expenses reimbursed to an employee. Therefore, if an employee submits a €20 invoice, but the reimbursement limit is €10, only the VAT on the €10 will be reclaimed, which is 50% of the total VAT.

In cases where an invoice has multiple VAT rates, the recovery will be based on the reimbursement percentage of the expense.

For example, if an invoice of €17.40 has VAT rates of 20% and 10%, and only €15 is reimbursed (equivalent to 86.21% of the total invoice), then the VAT will be recovered at 86.21% of the 20% and 10% VAT rates.

In summary, VAT recovery on Expensya is based on the percentage of expense reimbursement. These rules are detailed in the following article: How to configure expense rules.

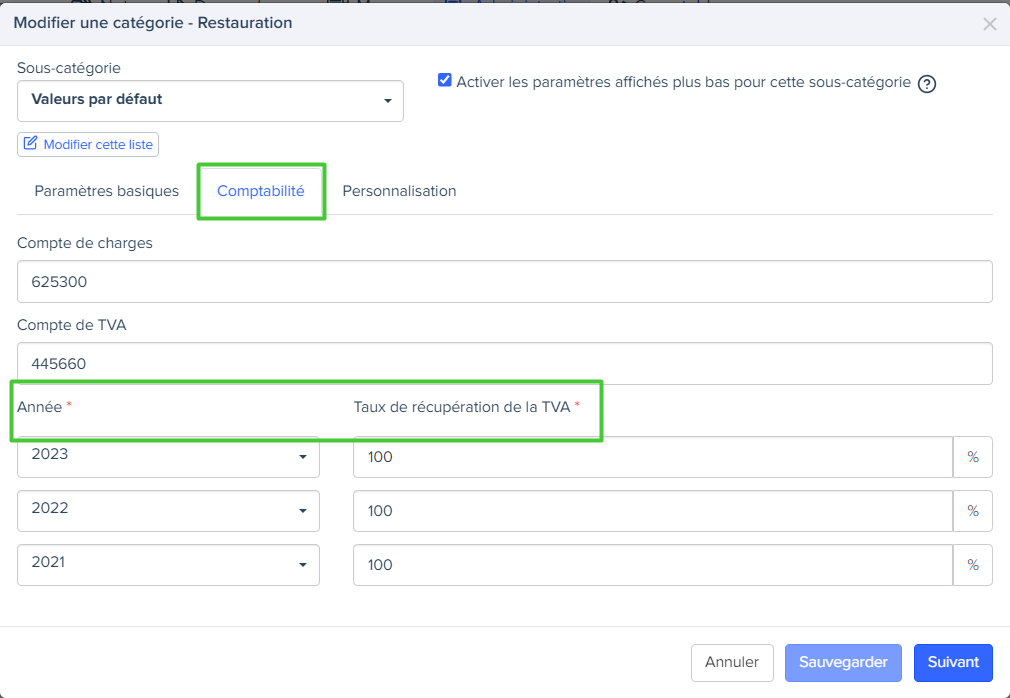

Configuration of VAT Recovery Rates

The VAT recovery rates per year can be configured through the expense category customization interface.

To do this:

- Go to the Admin tab and then select Advanced Settings.

- Access the Categories submenu.

- Click on the category you want to modify.

- Go to the Accounting tab and configure the VAT recovery rates by year.

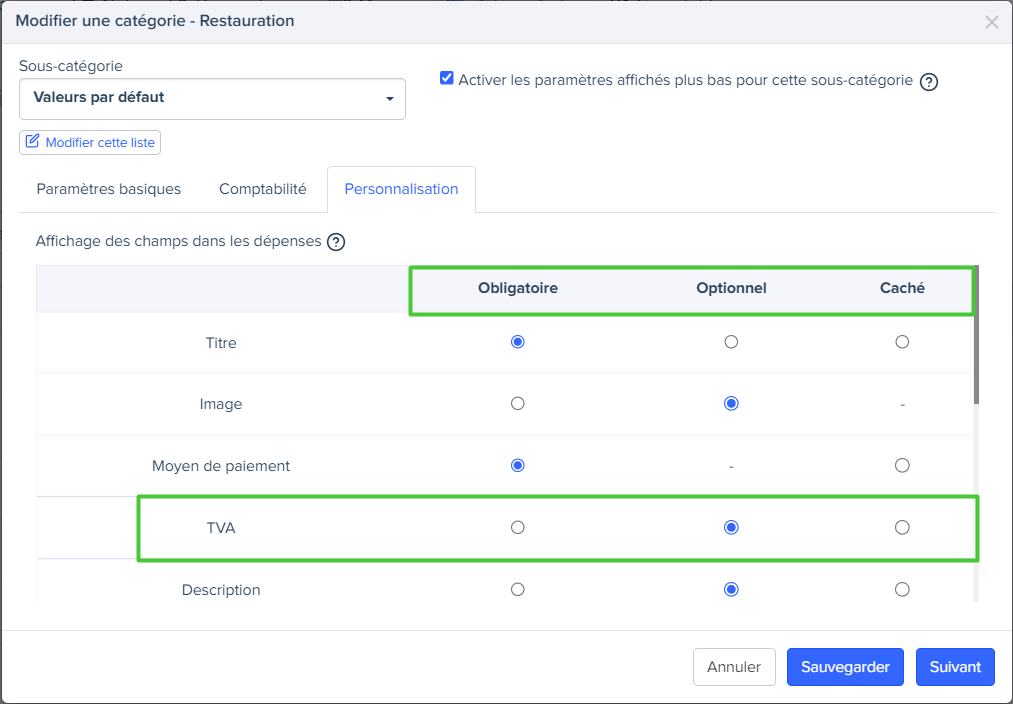

It is also possible to hide the VAT field on the expense form when VAT is not recoverable or when an expense is incurred abroad. This configuration can be accessed through the expense category customization interface.